How To Hire a Hacker to Fix Credit Score.

How To Hire A Hacker To Fix Credit Score

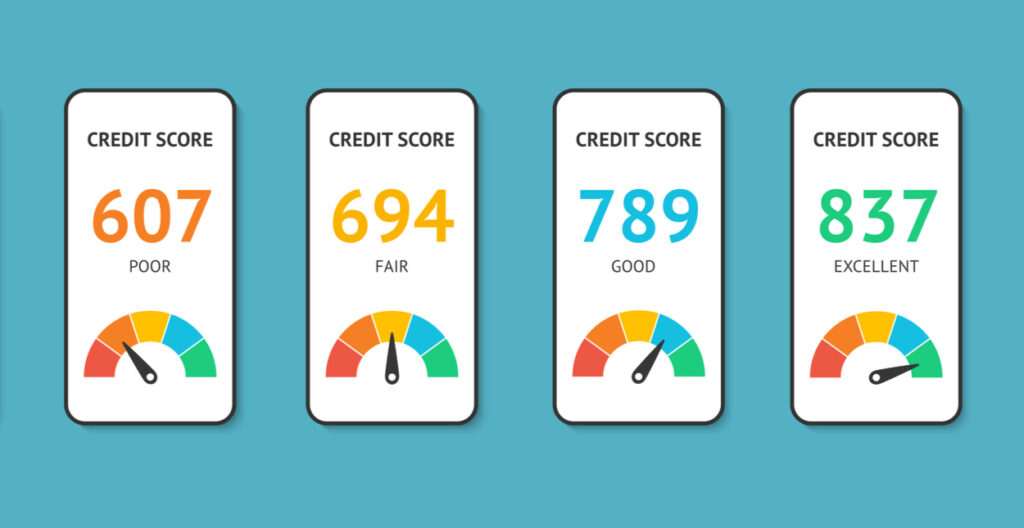

To fix a bad credit score, understanding the basic contributors to credit score is key including whether you pay your bills on time and whether you carry balances on credit cards and identifying the factors that are making a negative impact. Checking for errors on your credit report is also an important step.

A bad credit score can lead to these roadblocks:

- Possible rejection for loans and lines of credit. These can include mortgages, car loans, personnel loans, student loans, some federal student loans for parents and graduate students, and credit cards.

- Difficulty getting a rental application approved. Many landlords run credit checks to evaluate the payment history of prospective tenants, to know if they will be paying rent on time.

- Required security deposits. Utilities including gas, electricity and water may require you to make a security deposit when moving into a new home.

- Trouble getting a new cell phone contract. Many wireless providers check credit before taking you on as a customer, although you can always opt for the prepaid plan that has nothing to do with your ability to pay back.

- Issues during an employment background check. Employers may view a limited version of your credit report as part of the background screening process. This is most common when you are applying for a financial role in a firm, the employer will want to know how you handle your finances before trusting you with theirs.

- Higher insurance premiums in some states. Car insurance companies, for example, often use information from your credit report, in addition to your driving history, to assess your potential risk of submitting a claim. However, states like Hawaii, Massachusetts and California don’t consider your credit history for car insurance.

How to Improve a Bad Credit Score

Credit scores aren’t static; they change when the data in your credit report changes. This means it doesn’t matter where your credit score is currently, you can always change it by making financial moves that positively affect it. Here’s how.

1. Check Your Free Credit Score

First, check your credit score for free to view the factors that are most affecting it.

It’s also essential to check for any errors on your credit report, including erroneous personal information or accounts fraudulently opened in your name. Especially if it’s negatively affecting your score, dispute this information with the credit bureaus. Submitting a dispute does not affect your credit itself. But if any content in your report changes, your score could change too.

2. Pay Your Bills on Time

Payment history is the largest contributor to your credit score, accounting for 35% of your credit score. To avoid poor credit scores set up an automatic payment system for your loans. Your bill will be directly disbursed by your bank on its due date, meaning you don’t have to remember to log in to a payment portal or manually make a payment.

If most of your bills are due on the same day, you can easily change the payment time with your creditors. It is important to know that this change might take a few billing cycles before the change is reflected, so keep paying at the normal time till the change is effective.

It’s also important to be upfront with creditors about your ability to pay. Federal student loans, for instance, come with alternative payment plans that can lower the amount you owe each month.

Credit card issuers also may be able to reduce your payment or interest rate for a while if you’re undergoing financial difficulties. If there is a chance that you’re going to miss a payment, contact your creditor before it happens to explore what’s possible.

3. Boost Your Credit

One way to strengthen credit using your existing financial history is through an Expert (Financial Assets analyst) When you file a case on Recoveries Pro the analyst will go through your bank account data for utility, phone, and cable payments, and you can choose which accounts to add to your credit file. Once the accounts are added, a new credit score is instantly generated. Those who have little or poor credit could see an increase in their credit score thanks to the addition of new positive payment history.